Fundamental vs Technical Analysis

What Is Fundamental Analysis?

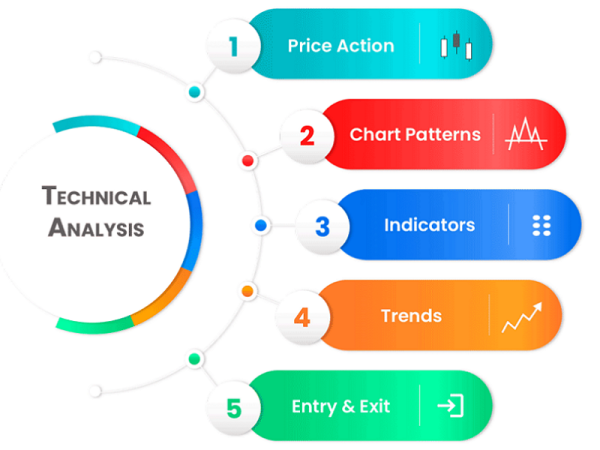

What Is Technical Analysis?

Difference, Tools and Objectives

Advantages and Disadvantages

Advantages of Fundamental Analysis

Longevity: perhaps one of its main advantages is the fact that fundamental analysis provides a long-term outlook on the markets.

Value: since fundamental analysis uses financial data it can help traders spot valuable market assets and trading opportunities. In addition, it gives traders a more nuanced perspective on the market.

Alerts: fundamental analysis keeps traders informed and alerts them on any problematic prospects when it comes to their underlying asset. Therefore, traders can use it to determine when to enter or exit a position.

Disadvantages of Fundamental Analysis

Timing: while the fact that fundamental analysis can be a good type of trading tool for long-term investors or traders, it means that data can take a long time to materialize which makes it less attractive to those seeking short-term gains.

Biased: those who critique fundamental analysis claim that it is hard to be objective when attempting to see the intrinsic value of a financial asset.

Advantages of Technical Analysis

Up-to-date Data: since technical analysis relies on price patterns, it is considered to be up-to-date, making it a good tool for those who seek to understand the current market trends.

Timing: technical analysis price charts can help traders time their trades which means that through technical analysis traders can base their decisions on past patterns. This is because technical analysts believe that history can repeat itself.

Disadvantages of Technical Analysis

Lack of accuracy: some posit that technical analysis is not precisely accurate and since past performance does not necessarily influence future results, technical analysis can sometimes be misleading.

Lack of objectivity: despite the fact that technical analysis uses existing data from events that already took place, technical analysis is often criticized for its lack of objectivity. The reason for this is that different individuals can analyze the data in different ways.