How To Trade Commodities In Pakistan

To trade commodities and currencies, investors have to contact Blink Capital Management (Pvt.) Ltd which is duly registered with SECP under Commodity Exchange and Futures Contracts Rules, 2005. This is because only specific brokers can provide the trading platform to their traders and investors to deal in commodities trading.

The first step is the client’s Biometric Verification. For this purpose, the client will have to visit Blink Capital Office. Remote Biometric Verification is also available in the cities of Karachi, Lahore and Islamabad. For remote biometrics.

The account opening form can be downloaded from our website, Fill and sign each page of the form, sign the risk disclosure document, commission structure and general guidelines, and then attach a valid copy of your and your nominee’s (N.O.K) CNIC.

You will also fill out the NCCPL‘s Know Your Customer (KYC) form for individuals, which is available in the ‘’Invest’’ tab of our website. Please attach all applicable supporting documents with this form. Your trading account will be operational within 2-3 business days.

Upon obtaining the client credentials, Blink Capital Management (Pvt.) Ltd forwards the same information to the Pakistan Mercantile Exchange (PMEX) for registration of Unique Identification Number (UIN) clients through the platform of the National Clearing Company of Pakistan (NCCPL).

In the next phase, Blink Capital Management (Pvt.) Ltd opens the trading account of its client. Now you can transfer funds to your account directly to PMEX by using the Automated Direct Funds Model (ADFM.

After completion of the account opening procedure, the client will have direct access to the market by placing the order directly through MetaTrader 5 of the Pakistan Mercantile Exchange. For further details kindly watch the below video from BCM’s official YouTube Channel.

BCM Head Office, Lahore

Advantages Of Futures Contracts

Hedging

Hedgers are those producers of commodity (e.g. an oil company, a farmer or a mining company) who come to a futures exchange in order to manage the price risk of their underlying business, assets or holdings.

For example, if the farmer thinks the cost of wheat is going to fall by the time the crop is harvested, he will sell a futures contract in wheat. This means one can opt for a trade by selling a futures contract first and then leave the trade later by buying it. Farmers need to hedge the risk of falling crop prices whereas airlines need to hedge the risk of rising fuel costs. On the opposite side, millers need to hedge against rising crop prices as these are their main input commodities.

Low Execution Cost

To own a futures contract, an investor only has to put up a small fraction of the value of the contract (usually around 10%) as a margin. The margin required to hold a futures contract is therefore small and if he has predicted the market movement correctly, he receives huge profits.

Liquidity

Because there are huge amounts of contracts traded every single day, there is a great chance for market orders to be placed very quickly. For this reason, it is uncommon for the prices to leap a jump onto a completely new level hence trading in futures contracts are very liquid.

Understanding Futures Contracts

Each futures contract is denominated in a specific currency. For example, CME contracts are denominated in US dollars, but EUREX contracts, in contrast, are denominated in euros.

Remember: Each commodity futures contract has a certain quality and grade. This is what they call “standardization”. For example, a Gold contract is 99% pure gold. Often you will see the same contract traded on different exchanges.

For example, you may see the crude oil traded in the CME and the crude oil on the ICE exchange. However, these contracts have different grade values. The CME trades “sweet crude” while the ICE exchange is trades Brent crude oil.

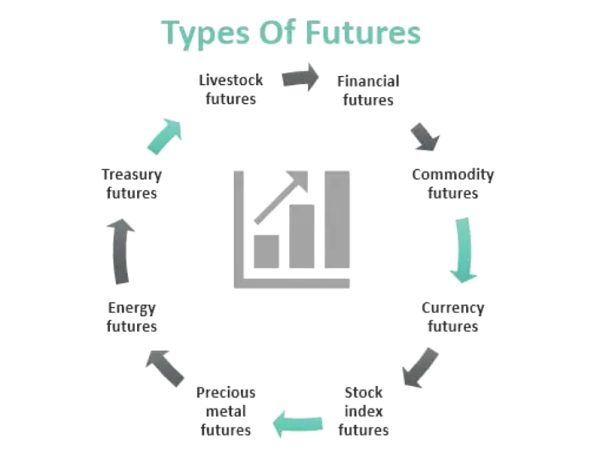

Types of Futures You Can Trade In Pakistan

Stock Indices: S&P 500, NASDAQ, DOW JONES and NIKKEI 225

Energies: Crude Oil, Brent Oil, and Natural Gas

Metals: Gold, Silver, Copper, Platinum and palladium

Currency Futures: Euro British Pound, Japanese Yen, Australian Dollar, and Canadian Dollar

Agriculture: Cotton and Wheat