Futures Trading Margins

What is margin?

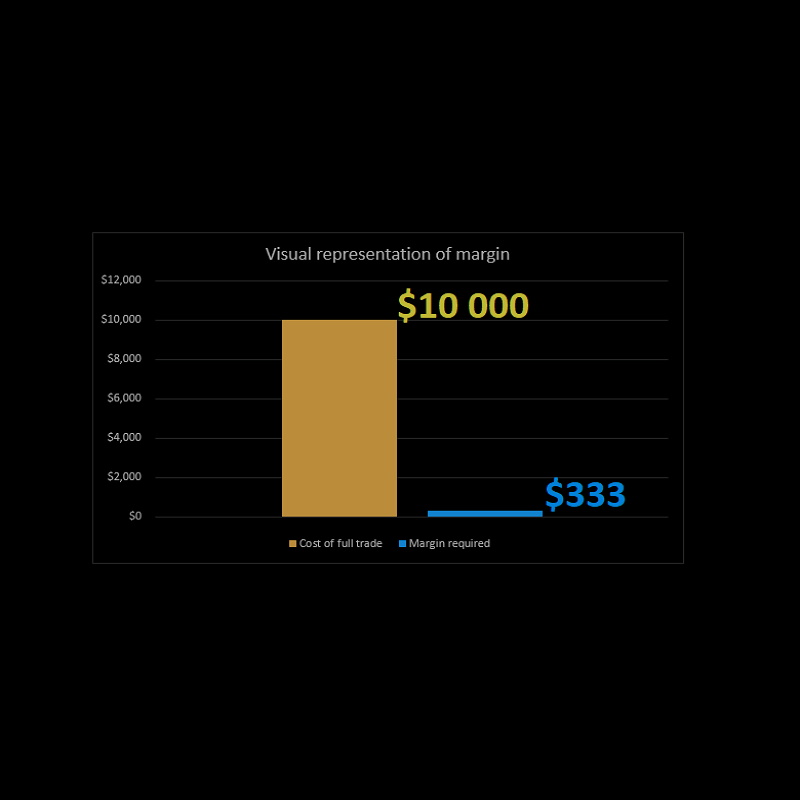

Futures and commodities are traded on margins. Margin is like “earnest money,” in which you are required to set aside a certain portion of funds in order to trade a futures contract by borrowing money from your Exchange. It’s almost like a “down payment,” but for holding an open speculative position rather than a sale.

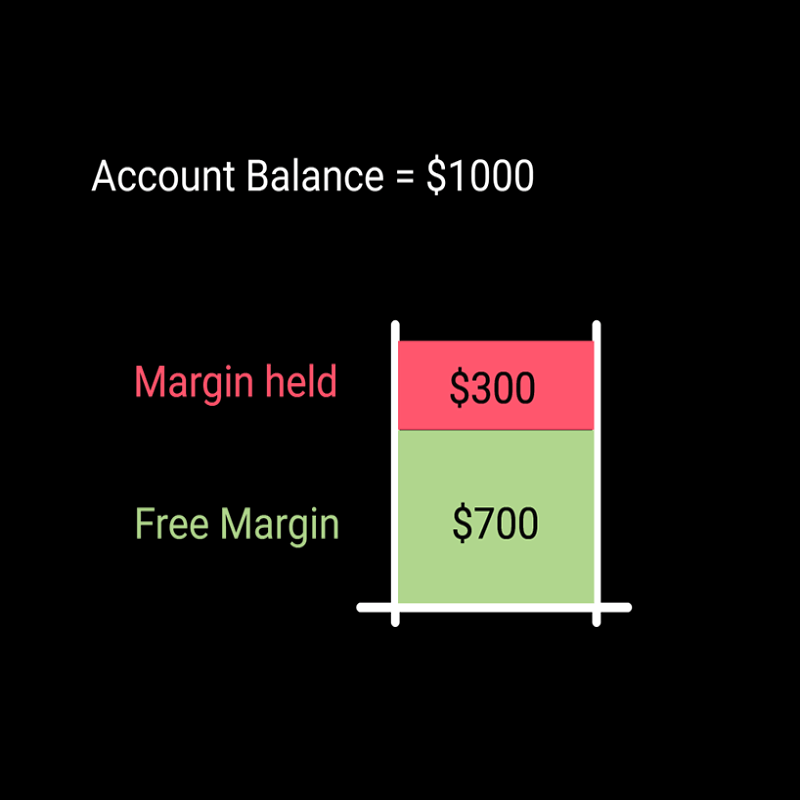

Is the margin taken out of my account?

Yes, and it’s given back to you once you close the transaction.

If I still have money left in my account left after I post the margin, can I use the rest to trade other futures and commodities?

Yes, you can. Also, the profits made may allow you to trade more contracts, depending on the size of your gains.

What is the maintenance margin?

This is the amount of capital that your account must remain above. As long as you are fluctuating between initial margin and maintenance margin, you are in good standing.

What Is A Futures Trading Margin?

What Is a Futures Margin?

A Future’s Margin is the amount of money that must be set aside as collateral in order to trade or maintain an open futures position. While this may resonate with the notion of down payments, it is important to note that a Futures margin differs from a down payment as it does not grant one ownership of the underlying asset. Moreover, there are essentially two types of margins that must be paid when trading Futures; initial margin and maintenance margin.

Initial Margin

The initial margin, as the name entails, is the initial amount of money that is handled by the broker and is susceptible to change on a weekly or daily basis based on volatility decreases or increases. This type of margin is also referred to as the “original margin,” which is the original margin applied at the time when the trade is first executed. In other words, the initial margin is a certain percentage of the overall initial price of the Futures contract.

Maintenance Margin

It is no secret that Futures contract prices might change from the initial price due to the fact that the markets are volatile and the underlying assets’ prices may drop over time. This is where the maintenance margin comes into play. The maintenance margin is, therefore, the amount that should be maintained in the account at all times to cover potential losses. This is because having sufficient money in your account when a futures position suffers a loss will allow traders to return the margin to its original level. Moreover, it is worth noting that the maintenance margin is less than the initial margin.

Intraday Margin

Another type of margin is called intraday margin which is the amount of money traders must have in their accounts in order to execute intraday trades, meaning buying and selling Futures on the same trading day.

Margin Call

A margin call is the amount of money the trader must pay in order to reestablish the initial margin that would qualify for keeping the Futures contract open. Margin calls aim to protect the broker or the Futures provider from incurring more losses than the customer can handle. This is why the traders are expected to cover their losses. In other words, if the margin call is not answered by the trader, the broker or the Futures provider may choose to terminate the contract in order to protect the company from incurring more losses.

How Are Futures Margins Calculated?

Most Futures exchanges use a program called SPAN in order to set margins. SPAN calculates futures margin rates by measuring a wide range of variables in order to determine the amount for the initial and maintenance margin. Moreover, a key factor to consider when discussing margin calculations, is that setting margins is largely influenced by the volatility and the stability or instability of the futures market in question. Therefore, market conditions may affect the margin settings of exchanges and these may differ from one exchange to the other.

Difference Between Futures Margin and Stock Margin

A Futures margin differs from a regular stock trading margin. One way to understand the difference better is by comparing a stock’s margin with purchasing a house. Like a down payment on a house that is a certain amount of money paid upfront, a stock trader also pays a down payment which is called the initial margin. Further, in stock trading, the margin is similar to taking out a loan against your assets. But in futures, it’s like putting down a good-faith deposit, i.e. an indication of trust between the trader and the broker.

PMEX Margins

Margining

PMEX margining regime works on an efficient paradigm that aims to maintain a balance between margins and the needs of participants. Margins should be set according to the underlying risks of the traded contract. Lower margins can lead to defaults whereas excessive margining also harms market liquidity and can be a catalyst for defaults. While the exchange requires the same level of minimum margins from all participants, brokers have the authority to charge higher margins from clients according to their risk profile of the client. Brokers can also distinguish between clients in terms of margins and are allowed to have different margins for different clients. This is based on the view that a broker is the best person to judge the riskiness of a client as opposed to the exchange. Exchange requires a minimum level of margins from all brokers as all brokers are treated equally by the exchange. Brokers, on the other hand, can distinguish between clients. There are two primary levels of margins at PMEX that a broker has to deposit, Clearing and initial. Apart from that, there are other margins also listed below:

Initial Margins

Initial margins are specifically designed to cater to the market risk of open positions. Initial margins are required for each trading account separately with no netting across clients. Initial margins are considered the first line of defence in clearinghouse risk management, with clearing margins acting as the second line of defence. The initial margin is the minimum amount the exchange expects all participants to pay to the clearinghouse. It is the obligation of the brokers to collect margins from clients and pass them on to the exchange. In order to help brokers manage client risks, exchange regulations provide power to brokers for asking higher margins according to their own assessments.

Clearing Margins

Clearing margins also referred to as clearing deposits, are required from all active brokers of the exchange. The minimum level of clearing deposit required is Rs 500,000. Brokers can deposit a higher clearing margin as well. PMEX specifies a clearing margin for each commodity. A broker’s clearing deposit held at the exchange should always be enough to cover the overall exposure taken by all clients of a broker on a gross basis. There is no netting across clients or with the broker’s own proprietary positions. Under the regulations, a broker is the primary obligor for all his as well as his clients’ trades. Adequate clearing deposit paid to the exchange is a testimony to a broker’s ability to carry out business and financially support the exposures of all his clients.

As the clearing margin is different for each commodity contract, the amount of exposure a broker can take will also vary according to what commodities are being traded.

Variation Margins

All accounts are marked-to-market according to exchange-specified rules and times. After mark-to-market calculations are complete, the value of each account is updated in the official ledgers of the exchange. The purpose of the mark-to-market exercise is to determine the correct value and profit & loss of each account. Once losses have been identified and applied to loss-making accounts, their margin requirements are recalculated. Losses are debited straight away from account value, after which the margin requirements are recalculated and wherever there is a shortfall in margin requirement, a margin call is issued. The official issuance of margin call is through a margin call report available in CSR (Corporate Social Responsibility) as opposed to any specific, physical communication from the exchange. The latest margin call statement in CSR is the official notification from the exchange and brokers are required to view and monitor this report after each MTM. The requirement to pay the extra amount in order to keep the minimum level of initial margin is effectively the variation margin.

Delivery Margins

For certain contracts, the exchange specifies extra margins nearer the expiry. This is especially the case in deliverable contracts where risks associated with physical delivery are greater and the exchange wants to curb excessive speculation. In order to ensure that genuine traders who are interested and capable of making and taking delivery of commodities are active towards the end of the contract. For those participants who are only interested in price risk management, the imposition of delivery margins acts as a catalyst for rolling over positions to the next contract month. This practice also ensures that prices correctly reflect the underlying market and that a natural convergence occurs at the expiry of the contract. Delivery margins can be imposed towards the end of the trading of a contract or after expiry but before final settlement. Delivery margins can be in addition to initial margins or they can replace initial margins, depending at what stage of a contract they become applicable. The applicability of delivery margins is mentioned in the contract specifications document and other relevant circulars issued by the exchange.

Special Margins

The exchange can impose other types of margins as well if required by specific circumstances. These can relate to periods of excessive volatility, price inconsistencies, illiquidity, demand-supply mismatch, or any other factor deemed by the exchange as warranting additional margins. PMEX General Regulations give the exchange powers to impose additional margins as deemed appropriate. These are further defined through contract specifications or circulars.

Auto Liquidation

In order to provide better risk management tools to brokers, PMEX also provides an auto-liquidation facility. This essentially performs the same function as a stop-loss order. The difference is that in a stop-loss order, the trader specifies a specific price at which the order is activated. In auto-liquidation, brokers assign a specific account value (either in rupee terms or in percentage terms) at which all positions are liquidated. Auto-liquidation can be considered as an overall, account-level stop-loss order that liquidates all open positions of an account in order to preserve its value and stop it from going into negative.

Overnight Margins

What is the difference between day trading margins and overnight margins? Are they different?

Yes, totally different. If you keep positions past the day trading session, you will need to post the margin dictated by the exchange. BCM and clearing firms do not control the overnight margins. You must post exactly what the exchange dictates.

What is a margin call?

A margin call is when your cash falls below the necessary requirements to hold your futures positions. You must either liquidate all or partial positions. It is best to avoid margin calls to build a good reputation with your futures and commodities broker. Also, many brokers no longer give “margin calls” — they often liquidate enough of your position to keep you above the required margin level.

Transaction Fee

Fees and Commissions

Traders pay brokers’ commissions on a per-contract basis.

Exchange fees

The exchange charges per futures contract and the amount varies from one commodity to another.

Today’s commissions are also very low relative to the leverage that you get as a trader. For example, consider when you trade crude Oil you trade 1,000 barrels.

When trading Gold, it’s 100 ounces. The same goes for many other commodities, and that is why big traders overlook the cost because many times it is not material.