Futures Trading Terminology

Futures Trading Terminology; Physical vs Non-Physical

some commodities are physical, such as Crude Oil, Grains and metals. Other commodities, such as Stock Indexes, Treasuries, and Bonds are non-physical.

Futures Trading Terminology; Deliverable vs Cash-Settled

Similarly, some commodities are deliverable in their physical form. This process is used mainly by commercial producers and buyers. Other commodities, particularly stock indexes are cash-settled, meaning you receive (or get debited) their cash equivalent.

Note that just because a commodity is a physical commodity doesn’t mean its deliverable. Mini Gold futures may be deliverable, but their micro-futures may be cash-settled. When trading deliverable products, you must exit before a certain date otherwise you’ll be at risk of delivery.

Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. Make sure you discuss the exits dates with your brokers and the methods he uses to roll over to the next month.

Last Trading Day

These are two terms and abbreviations you should know: LTD and FND. One thing for certain is that you’ll want to avoid delivery notices and the cost of retendering (reversing delivery).

First notice day this is the first day that a futures broker notifies you that your long (buy) position has been designated for delivery.

the last trading day is literally the “last day” to close out a futures contract before delivery. This applies to both physically settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange.

For cash-settled contracts, like the E-Mini S&P 500 or E-Mini S&P 500 micro, traders who hold long or short futures contracts into the LTD close will have their positions cash-settled–meaning credited to or debited from your account. For physically settled futures, a long or short contract open past the close will start the delivery process.

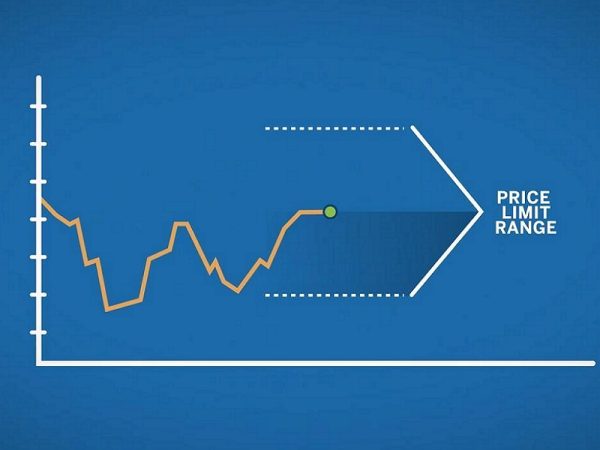

Price Limits

Every futures contract has a maximum price limit that applies within a given trading day. There’s a maximum upside limit and downside limit. These limits help ensure an orderly market by limiting both upside and downside risk.

Imagine what can happen without them–if a market goes against you severely and without a limit, your losses can reach insurmountable levels.

If a given price reaches its limit (limit up or limit down) trading may be halted. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules.

Each futures contract has its own unique band of limits. Each has a different calculation. Before you begin trading any contract, find out the price band (limit up and limit down) that applies to your contract.

Mark to Market

What Does Mark to Market Mean?

Futures gains and losses are taxed via mark-to-market accounting (MTM). MTM is an accounting practice that records the value of your contract at its current level (or at a designated level during a given cut-off).

For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. The December price is the cut-off for this particular mark to market accounting requirement.

What does it mean to roll over a Position?

A rollover means to close a position in the expiring month’s contract so as to initiate a position in the new month’s contract. There is no automated way to roll over a position. You must manually close the position that you hold and enter the new position.

Futures Trading Terminology

Spot Price

The spot price of an asset can also be referred to as the cash price, and it is the price at which the underlying or physical asset is bought or sold immediately.

Contract Size (Contract Unit)

A contract size or a contract unit refers to how much of an underlying asset is represented in a single futures contract. This relates to Stocks, Indices, and Commodities Futures among other types.

Contract Value (Notional Value)

In Futures trading, the contract value or notional value is calculated by multiplying the current Futures price by the contract size, and as the Futures price changes, so does the contract value.

Contract Expiration

Futures contracts all have expiration dates at which point any outstanding contracts are settled financially or physically delivered. Some assets have expirations every month, like Crude Oil, while others have fewer than 12 expirations per year, like Corn and the S&P 500. Multiple contract expirations are available to trade at any given time, but most trading occurs in a single expiration until it’s time to roll to the next.

Open Position

Buying or selling a Futures contract creates an open position until it expires or is liquidated.

Open Interest

In the Futures market, open interest refers to the total number of open positions for a particular underlying asset, which can include stocks, Indexes, commodities, and currencies.

Cost of Carry

The cost of carry is the difference between the cost of the Futures’ underlying asset and the returns it generates over a specific period of time. To put it another way, it is the net cost of maintaining a Futures position, with factors like the cost of holding a physical commodity, inventory costs, insurance, storage, and more coming into play.

Contract Month Codes

In the Futures market, each month and the underlying asset have their own symbol, and in order to understand when a Futures contract expires, it is important to know the relevant symbols for each month which go as such:

January (F), February (G), March (H), April (J), May (K), June (M), July (N), August (Q), September (U), October (V), November (X), and December (Z).

Commodity Futures Symbols

There is a myriad of commodity Futures to trade from metals to agricultural commodities and Energy. Here are a few of the possibly most important Futures symbols to keep in mind for some of the most traded assets:

Metals

The metals market has some base and precious commodities. Some of which, like Gold, are considered safe-haven assets that traders go to in times of inflation and economic turmoil. Some of the most important metals and their accompanying symbols include Gold (GC), Silver (SI), Copper (HG), and Platinum (PL).

Energy

The energy market is one of the most crucial and traded markets in the world as it is nearly impossible to survive in our modern world without any of the below-mentioned energy commodities. Accordingly, here are some energy commodities and their relevant symbols. Crude Oil (CL), Heating Oil (HO), Natural Gas (NG), Brent Crude Oil (BZ), and RBOB Gasoline (RB).

Agricultural

The agriculture market is one of the oldest forms of Futures trading still in use to date. Some of the most important agricultural commodities include Corn (ZC), Live Cattle (LE), Soybeans (ZS), and Lean Hogs (HE).

Indexes Futures Symbols

The Futures market offers access to important global market Indexes, some of which track the biggest companies in the world like the S&P 500 (ES) and the Nasdaq 100 (NQ).

Interest Rates Futures Symbols

Interest rates are key anticipated factors in the market and the economy as they directly affect inflation, deflation, and consumer prices. Benchmark rates change from time to time in order to control the aforementioned factors and through Futures contracts traders may potentially benefit from changes in key interest rates like the US Treasury Bond (ZB), Federal Funds Rate (ZQ), and the Eurodollar (GE), among others.

Forex Futures Symbols

The Forex market is considered the world’s largest financial market with some of the highest daily trading volumes and returns. It is also one of the most traded markets since people participate in it directly or indirectly. The Forex market is, therefore, a market sought by many and can also be accessed through Futures contracts. Some of the available Futures currencies include the Australian Dollar (6A), the Canadian Dollar (6C), the British Pound (6B), the Euro (6E), and the Swiss Franc (6S). Plus500 also offers micro Futures on some of the most traded Forex Futures pairs like the GBP/USD (M6B), and the EUR/USD (M6E).